Credit Risk & Score

信貸風險與

評分

Credit risk is a complex concept that takes into account multiple dimensions of credit data. We use sophisticated statistical models to convert credit data into fractions and present the credit risk profile in a simple way so you can see it at a glance!

Risk Score

To see comprehensive credit status at a glance

Risk Score

Risk Score is a numerical expression to represent the “credit risk” (also known as the probability of default) of an individual. It ranges from 300 to 800, the higher score represents the lower risk level. The score illustrates the likelihood of an individual becoming 90+ days past due over the next 12 months.

Risk Score is one of the major factors in credit decision process of financial institutions.

All Rounded Credit Data Considered

Developed with sophisticated statistical model and calculated based on information of credit report including 5 major categories: Payment History, Debt Burden, New Account and General / Enquiry Records.

Payment History

Debt Burden

New Account

General Enquiry Records

Credit Mix

Bankruptcy Score

Bankruptcy Score is a numerical expression of the likelihood of a consumer being bankrupted over the next 12 months. The higher score represents the lower probability of bankrupt.

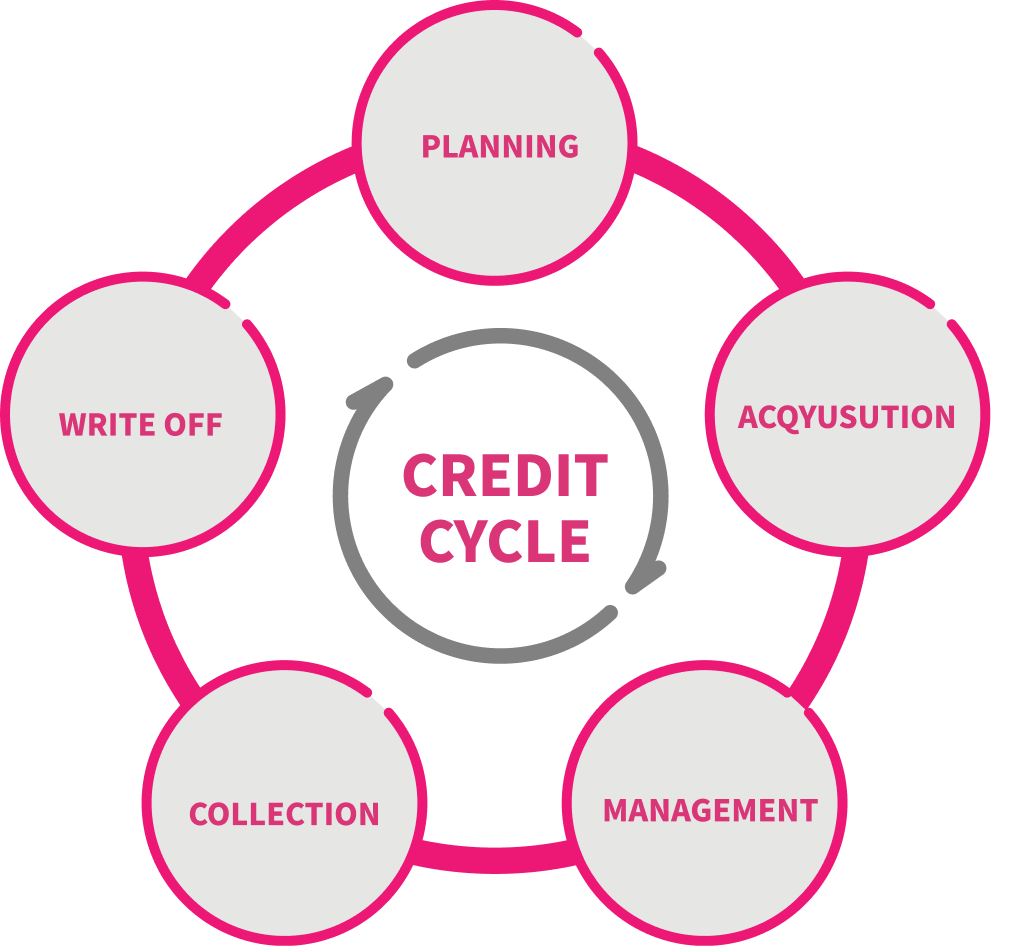

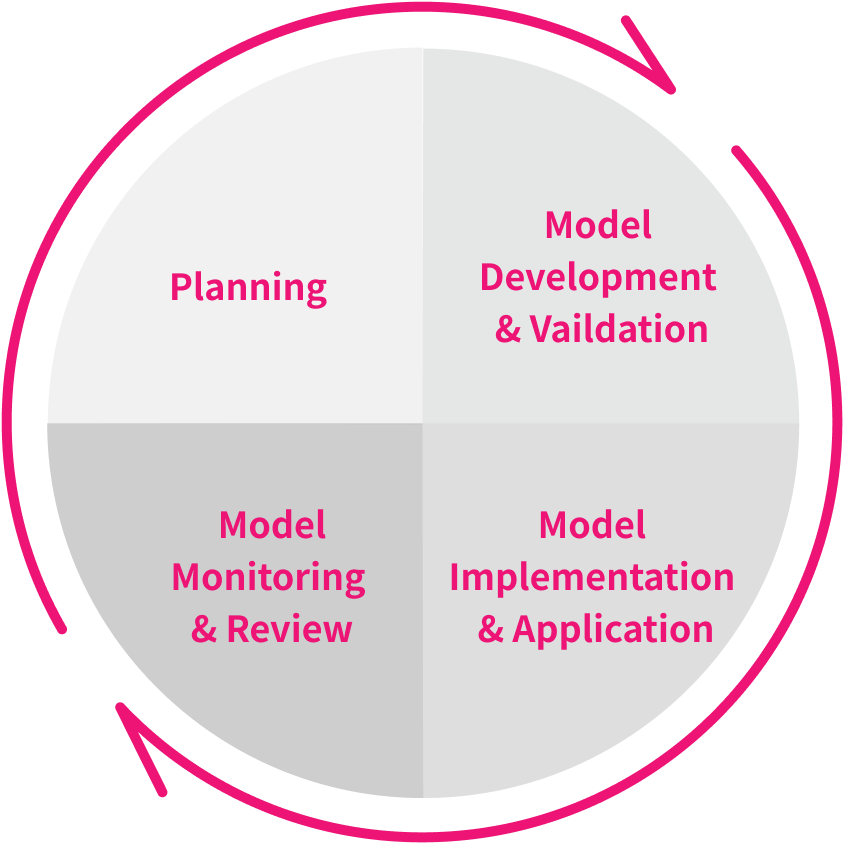

Customized Score

The combination of our professional analytics and the client’s data to customize different types of scores to further help financial institutions to manage risk levels in credit cycles.

Offer customized services in model life cycle

Types of customized score

- Customer Credit Product Application Score

- Customer Credit Behavioural Score

- Collection Score / Collection Amount Estimation

- Recovery Score/ Recovery Amount Estimation

- Risk Segmentation

- Other types of model

Expert Credit Risk Score

Expert Credit Risk Score is a customized score developed by our risk experts based on extensive experience in the local banking and credit reference agency industry.

Help financial institutions manage risk levels effectively in insufficient credit data.

Expert Score Product features

No restriction on the amount of data

No restriction on the amount of data

Developed by industry experts with scientific technology

Developed by industry experts with scientific technology

Able to develop tailored models in a short period with top of the line standard

Able to develop tailored models in a short period with top of the line standard