Greater China Focus

內地業務

Cross-Boundary Customer Credit Report Verification (CBCRV)

The deepened cooperation between mainland cities and Hong Kong drives significant growth of cross-boundary financial activities. However, the current barrier of cross-boundary data transfer is a critical restriction for Hong Kong financial institutions to effectively conduct risk assessments for mainland clients, including the Know You Customer (KYC) procedures for account opening and risk management of credit applications, thereby missing the huge potential market and business opportunities.

NOVA’s Cross-Boundary Customer Credit Report Verification (CBCRV) has taken the lead in establishing a compliant channel for the first-to-market cross-boundary verification service of personal credit reports issued by the Credit Reference Center, the People’s Bank of China, to address the challenges encountered in the financial industry.

Advantages of CBCRV:

Advantages of CBCRV

The only provider of such verification service in Hong Kong

The only provider of such verification service in Hong Kong

Authentic personal credit reports from the Credit Reference Center, the People’s Bank of China

Authentic personal credit reports from the Credit Reference Center, the People’s Bank of China

Verification services covering the whole country

Verification services covering the whole country

Up-to-date and comprehensive personal financial information from the verified credit reports

Up-to-date and comprehensive personal financial information from the verified credit reports

Reports fit for internal audit purposes of financial institutions

Reports fit for internal audit purposes of financial institutions

Consultation service for the Filing of the Standard Contract for Cross-border Transfers of Personal Information

The Cyberspace Administration of China (“CAC”) promulgated the Measures on the Standard Contract for Cross-border Transfers of Personal Information (the “Standard Contracting Measures”) that became effective on 1 June 2023.

Enterprises and organisations transferring personal data out of the mainland, regardless of the quantity, must first enter into a standard contract and file it with the provincial-level cyberspace administration authority.

Please click here to read the Standard Contracting Measures and template of the Standard Contract for Cross-border Transfers of Personal Information.

NOVA’s Cross-Boundary Customer Credit Report Verification service has been successfully filed with the Chinese local cyberspace administration authority following the Standard Contracting Measures. NOVA is the first Hong Kong organisation to achieve this.

We are delighted to assist Hong Kong businesses on a non-profit basis by sharing our experience and key principles for filing the standard contract along with guidance on integrating cultural and standard requirements of the mainland and Hong Kong regions. And we hope that our experience sharing can benefit Hong Kong enterprises and organisations in developing cross-boundary businesses and promoting cross-boundary data flow.

To learn more, please contact us at [email protected] or call 3854 0188 .

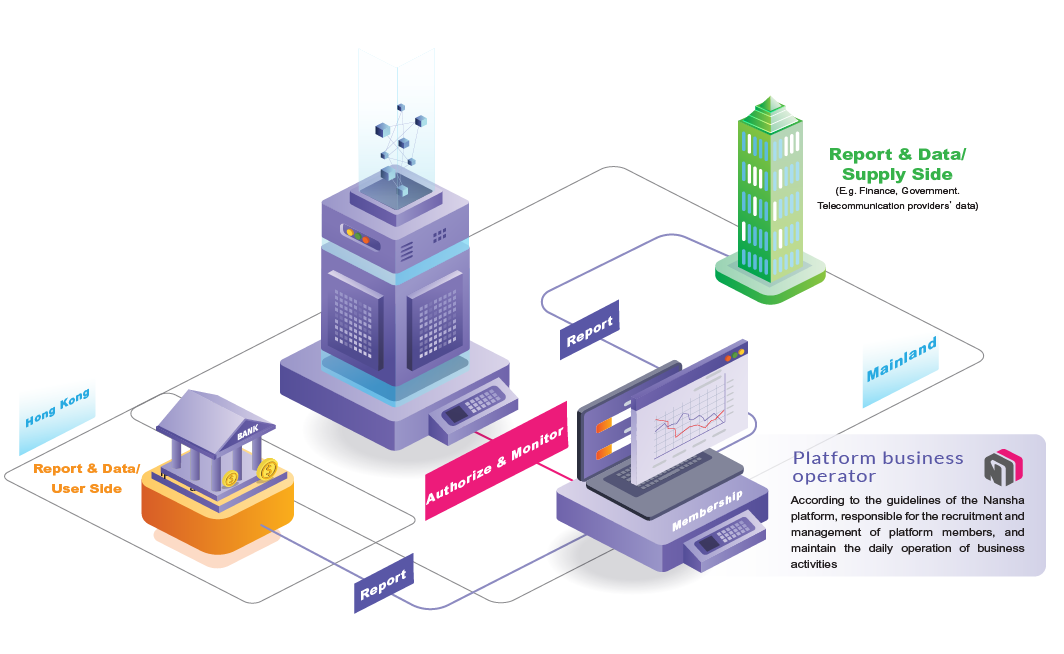

In order to promote in-depth cooperation within the Greater Bay Area and facilitate the regional circulation of data, the Guangzhou Nansha Government has built the “Greater Bay Area Cross-boundary Data Mutual Recognition Platform” (“Nansha platform”) in Nansha. It realizes the cross-boundary transmission of data and information to promote business development between Mainland China and Hong Kong.

BENEFITS OF THE PLATFORM FOR HONG KONG FINANCIAL INSTITUTIONS (MEMBERS)

The Nansha platform is developed with the support of the Guangzhou Nansha government, a legitimate platform that can solve the compliance problems of members in cross-boundary data transmission.

The Nansha platform is developed with the support of the Guangzhou Nansha government, a legitimate platform that can solve the compliance problems of members in cross-boundary data transmission.

Having a rigorous member approval mechanism to ensure that the source of data providers is true and reliable, so as to reduce the pressure on members to check the authenticity of data sources.

Having a rigorous member approval mechanism to ensure that the source of data providers is true and reliable, so as to reduce the pressure on members to check the authenticity of data sources.

Providing the possibility of cross-boundary business cooperation to create more business opportunities for members.

Providing the possibility of cross-boundary business cooperation to create more business opportunities for members.

Solving the differences in the use of data between Mainland China and Hong Kong, so that members can obtain more information from Mainland China for expanding business.

Solving the differences in the use of data between Mainland China and Hong Kong, so that members can obtain more information from Mainland China for expanding business.

Supplying a proposal channel that members can regularly put forward the needs of cross-boundary affairs and business cooperation to the Nansha platform.

Supplying a proposal channel that members can regularly put forward the needs of cross-boundary affairs and business cooperation to the Nansha platform.

Improving the company’s brand image by becoming a member through the review of the Nansha platform.

Improving the company’s brand image by becoming a member through the review of the Nansha platform.

Cross-boundary customer due diligence service – Cross-boundary KYC

With the rapid financial integration within the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), there have been growing demands for cross-boundary KYC in the Hong Kong financial sector. However, the channels are limited for verifying individual identities and information of Mainland China customers in the market. We are the first credit reference agency to provide cross-boundary KYC in Hong Kong, intending to fulfill the increasing market needs and mitigate financial risk.

Strengths

Customer identification and verification services covering the whole country

Customer identification and verification services covering the whole country

Latest status of customer profile

Latest status of customer profile

Key Features

Reliable and comprehensive KYC solutions for financial risk assessment and mitigation

Reliable and comprehensive KYC solutions for financial risk assessment and mitigation

Increase efficiency and accuracy of customer due diligence process

Increase efficiency and accuracy of customer due diligence process

Legitimate data sources from reliable partners

Legitimate data sources from reliable partners

Reports are available for audit purposes

Reports are available for audit purposes

Business Background Check

KYB (Know your business) is a crucial process for financial industries to identify and verify the business customer’s beneficial ownership and source of funds, etc.

However, there are very limited cross-boundary KYB and on-site visit services available in the current market for background checking of Mainland China companies. Cross-boundary KYB services may cause additional costs and resources for the process to ensure compliance with PRC and Hong Kong regulations.

Business Background Check Report

Business Background Check Report is a solution for financial institutions in providing KYB reports of Mainland China companies. It helps to gather business information of Mainland China companies legally and conveniently for customer due diligence, portfolio review and account opening. Our solution can enable financial institutions to offer cross-boundary services at a lower cost and provide a better customer experience for clients from Mainland China.

Business Information Report

NOVA has partnered with the leading operator for integrated business and commercial information – CRIF SPA, to deliver Business Information Reports with the latest corporate information across more than 230 countries and regions.

Business Background Check Report Features

KYB reports and monitoring services can provide basic information, in-depth business information, directorship, and litigation records of Mainland China companies. Our solution allows users to inspect if the business of client is under normal operation as well as on a daily basis to monitor the business status in order to identify potential risks and abnormalities at an early stage.

Basic & In-depth Business Information

Directorship

Litigation Records

NOVA Check

NOVA Check is a screening solution for detecting, managing and preventing risks for KYC. This service allows financial institutions to verify whether an individual customer has any negative records or political background.

NOVA Check is available for financial institutions from both Hong Kong and GBA.

NOVA Check features

Legitimate sources for screening, including international sanction lists, politically exposed person, negative information, bankruptcy and tax-related information.

International Sanction List

Politically Exposed Person

Negative Information

Bankruptcy and Tax Related Information

Related News

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)

(Read more)