Seminar on “Inspiration from Credit Reference Interconnection in the GBA” Convened on 25 June 2018

Following the successful organisation of the Forum on “Facilitating SME Development in GBA and Forging International Cooperation on Credit Reference” (the “Guangzhou Forum”), Nova Credit Company Limited (“Nova Credit”) held a seminar on “Inspiration from Credit Reference Interconnection in GBA” in Hong Kong on 25 June 2018. The Seminar was well received with the participation of representatives from 16 financial institutions. The Seminar began with the introduction of Nova Credit’s vision and its business strategy in the Greater Bay Area (the “GBA”). Two industry experts were invited to give keynote speeches, followed by demonstrations of three application scenarios of financial technologies selected from the latest technology sandboxes.

The Guangzhou Forum was held on 22 June 2018, the opening day of the 7th China (Guangzhou) International Finance Expo (“GZIFE”).

|

In his welcome speech, Mr. Dickson So, Chairman of the Board of Nova Credit, stated that the company had started with the aspiration to help establish risk management and financing products for the banks. He emphasized that offering solutions integrating advanced technologies with a great amount of data is the fundamental role of credit reference service providers. Most importantly, they should look after the vital needs of banks, including improvement of risk management, advancement of asset quality management and control, as well as effective control over risk price and precise prediction of risk costs. |

|

| Dr. Liu Xinhai, researcher of the Intelligent Financing Research Centre of Beijing University and author of Credit Reference and Big Data, delivered a keynote speech titled “Credit Reference in GBA and Nova Credit’s Opportunities”. He analysed the prospects of the future credit reference interconnection in the region and reviewed the development and the market of credit reference in mainland China. He also introduced the characteristics of China’s new credit reference system in the era of Internet and big data. |  |

According to Dr. Liu, the Guangdong-Hong Kong-Macao Greater Bay Area has a well-developed market economy, which accounted for 11.8% of the GDP in 2017, with a population reaching nearly 70 million. In addition, the GBA has a vigorous digital economy and a huge consumer finance market. In particular, Hong Kong enjoys the advantage of being an international financial centre, having a professional talent pool and relevant experience, as well as an open economy with globalised perspective. The GBA would become the pioneer in diversified credit reference, thus hopefully break the deadlock of China’s credit reference development, he said.

Cross-border credit reference is essential for globalised economic integration, Dr. Liu said. The GBA has unique geographical and cultural advantages, spanning three places across the Taiwan Strait, linking Europe and the United States, and facing Southeast Asia (ASEAN). At the same time, China’s One Belt One Road initiative requires financial infrastructure support. The GBA inherits competitive edges in developing cross-border credit reference.

Dr. Liu concluded that China’s credit reference system has yet to mature, and the key and hope of the future credit reference system lie in the innovation in technology and business model. Finally, he placed his confidence in Nova Credit’s unremitting efforts in exploring the road to new credit reference that meets the needs of China’s future economic development and bringing new changes to the market.

|

In her keynote speech titled “Credit Reference Interconnection: A Legal Perspective”, Ms. Catherine Mun, Partner of Li & Partners, gave an overview of the protection over individual private information enforced by relevant laws and codes of practice in Hong Kong, as well as the supervision system in the usage. She then discussed several to-be-effective legal provisions in relation to cross-border information transfer and their interpretations: |

1. The country to which the personal data will be transferred is on the “white list” – places where the law is substantially similar to, or serves the same purposes, as the PDPO (“Personal Data (Privacy) Ordinance”).

2. Data user has reasonable ground to believe that the law of the transferred country is substantially similar to, or serves the same purposes, as the PDPO.

3. Data subject has consented in writing to the data transfer.

4. Data subject has reasonable grounds for believing that the transfer is for the avoidance or mitigation of any adverse action against the data subject, and it is not practicable to obtain the data subject’s consent, but if it were, then such consent would be given.

5. The personal data is exempted from Data Protection Principle 3 under the PDPO.

6. Data user has taken all reasonable precautions and exercised all due diligence to ensure that the personal data will not be collected, held, processed or used in a manner that would constitute a contravention of the PDPO.

She pointed out that the personal data protection laws in Hong Kong is mature and is in line with internationally accepted standards. It is effective and can serve as a reference for the establishment of a cross-boundary credit reference system in the GBA.

| Lastly, Mr. Samuel Ho, CEO of Nova Credit, took the opportunity to introduce the company’s business strategies and solutions. He reviewed the successful signing of the strategic cooperation memorandums at the Guangzhou Forum on “Facilitating Development of SME in GBA and Forging International Cooperation on Credit Reference” held during the GZIFE. He shared with the guests that Nova Credit would provide the industry with internationally superior products and services through in-depth cooperation and collaboration with both domestic and foreign institutions and organisations. |  |

Lastly, Mr. Samuel Ho, CEO of Nova Credit, took the opportunity to introduce the company’s business strategies and solutions. He reviewed the successful signing of the strategic cooperation memorandums at the Guangzhou Forum on “Facilitating Development of SME in GBA and Forging International Cooperation on Credit Reference” held during the GZIFE. He shared with the guests that Nova Credit would provide the industry with internationally superior products and services through in-depth cooperation and collaboration with both domestic and foreign institutions and organisations. adeshift®, one of Nova Credit’s strategic partners, has the world’s largest business-to-business (B2B) supply chain finance platform, according to Mr. Ho. This platform enables small and medium-sized enterprises (“SMEs”) to carry out the whole operating process ranging from procurement to ordering and from invoice to payment. It covers aspects such as supply chain, finance, dynamic discount, as well as receivable financing, factoring, virtual credit card and electronic commerce of SMEs. Tradeshift® Pay acts as a one-stop paying wallet which can connect clients’ supply chain payment to multiple banks. In addition, its data transaction platform not only records every order placed by SMEs, but also tells whether a certain enterprise is carrying out an actual business operation in real-time. Based on these data, Tradeshift® can provide a highly valuable reference for banks’ financing business for SMEs.

Mr. Ho pledged that Nova Credit would keep expanding its data coverage to better support the SMEs and the development of all industries. He reiterated the company’s vision: to create values for individual consumers, SMEs as well as financial institutions in the GBA, and usher in a new era for the credit reference industry and the field of credit risk management in Hong Kong.

|

Immediately after the Seminar, Mr. Eric Tsang, Chief Business Engagement Director of Nova Credit, led his team to demonstrate application scenarios of three financial technologies selected from the technology sandboxes: |

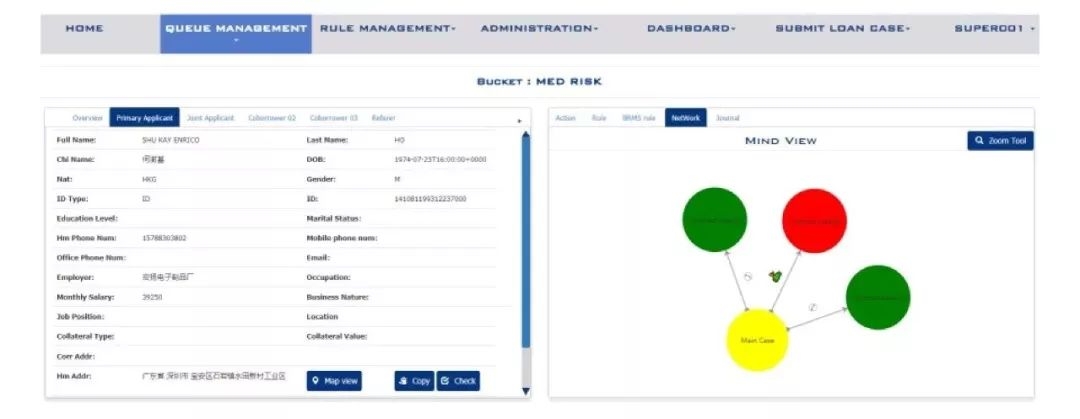

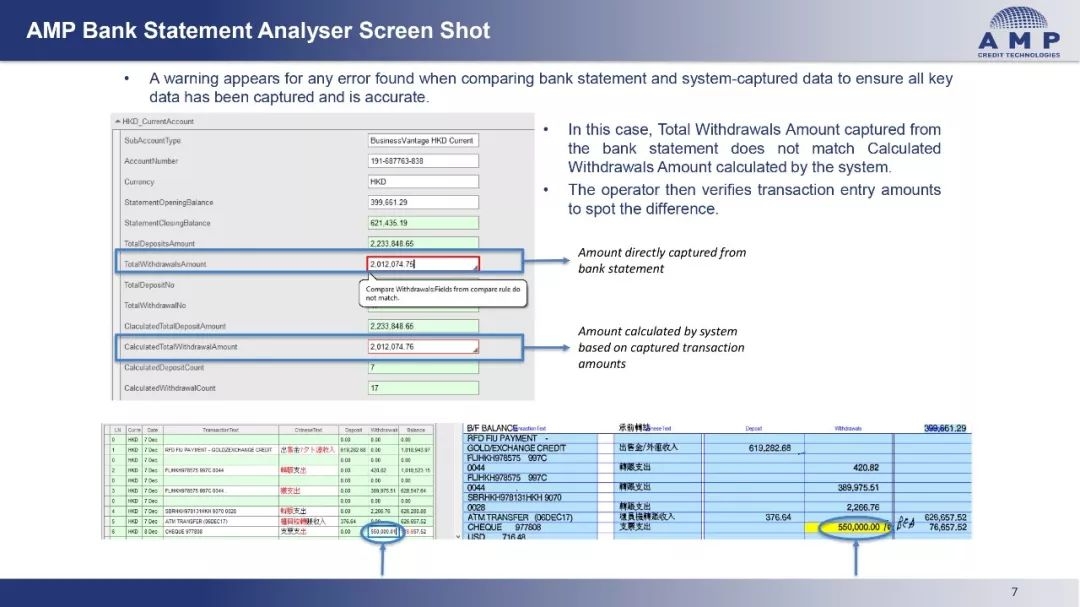

| Fast financing platform for SMEs — adopting artificial intelligence-enabled decision-making and analysis system and high-level identifying capacity of optical character recognition (OCR), the MSE sandbox with Fraud & AMR demonstrates the latest technology in assisting banks and financial institutions in enhancing efficacy, making effective and holistic risk decision-making in real-time and providing financial plans for SMEs. |

|

| Verification of Mainland Chinese Citizen Identity — retrieving information on the chip of mainland citizen’s second-generation identity card, including individual information, fingerprints and photos using hardware and software technologies exclusively authorised by the public institution directly affiliated to the law enforcement department of the People’s Republic of China. In addition, with the use of the technologies for identity card chip reading and bio-recognition technologies recognised by the government and conducted in accordance with the laws and regulations, the results of verifying identity information with facial and fingerprint biometrics can be obtained on site. It provides reliable, convenient and quick authentication solutions that are compatible with the database of mainland China. In this way, financial services in Hong Kong, such as opening bank accounts, will become readier and easier for Mainlanders. |  |

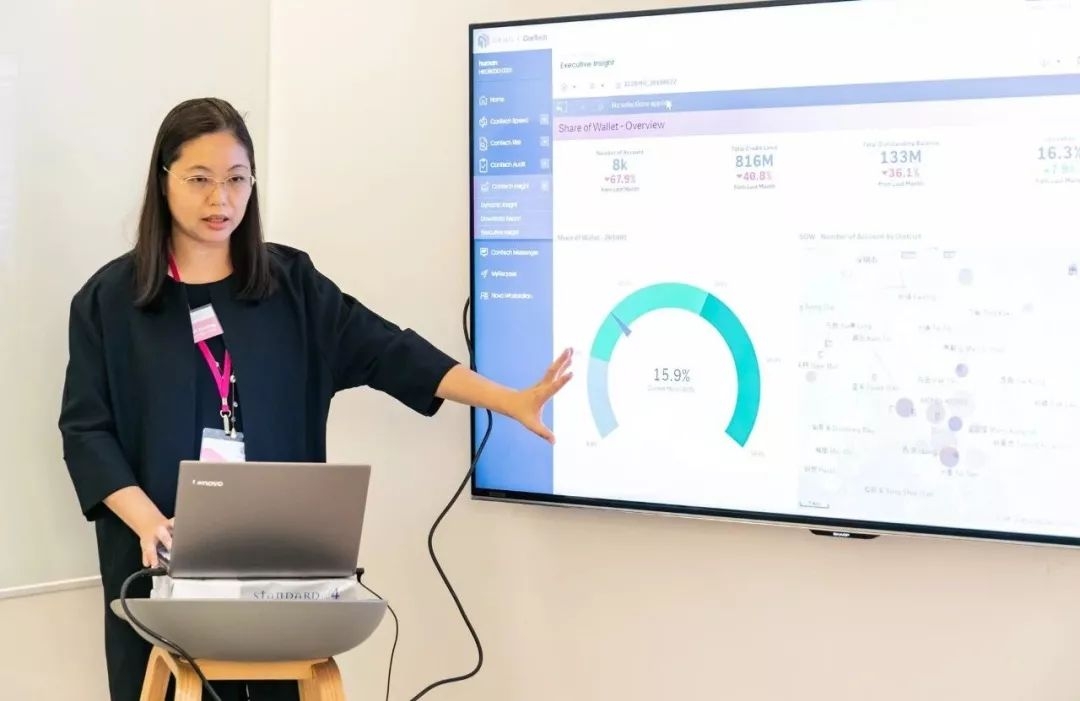

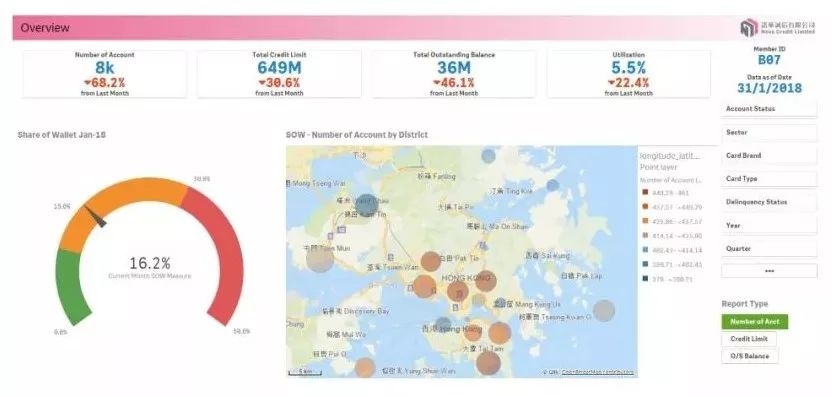

| Machine-learning Dynamic Analysis of Data — using simple access to the high-dimension data sources of internal and external subcontractors, while conducting cross-referencing through machine-learning analysis models, to allow bank operators to comprehend complex loaning, collection and risk management in a dynamic way. In this way, the business strategy can be adjusted in the shortest period of time while effectively preventing financial risks.

Nova Credit’s data centre was open to guests for the first time. The guests could experience firsthand the world-class security system, the advanced computing and operating capacities, and how the hardware and software can instantaneously process large quantity of data. |

|

An advanced and complete credit reference system with ranking standards and rating models internationally-recognized is requisite for the continuous development of a society’s financial system, and for the benefit of individual consumption, commercial credit and corporate financing as well. In the big data era, with the ever-growing financial products and emerging scientific and technological applications, the business world is awaiting companies that are customer-oriented, well-aware of the practical needs of the industry and capable of providing innovative and leading solutions in visionary perspectives.

It took Nova Credit less than a year to found and establish the company and develop the solutions, which was actually the crystallisation of decades of solid experience of the management team, alongside its collective expertise and technical strengths as well as persistent industriousness. The cooperation opportunity and business partnership forged by the strategic cooperation memorandums achieved at the GZIFE, together with the popularity and support of the Hong Kong Seminar, are valuable recognition and encouragement towards the company.

Nova Credit, founded and rooted in Hong Kong, enjoys the advantages of talent pool, technologies, resources and network provided by an international financial centre. It will stay humble and diligent, dedicate itself to the promotion and advancement of the development and progress of Hong Kong’s credit reference industry. Moreover, it will collaborate with all the like-minded businesses to construct the interconnected credit reference system of the GBA and to contribute innovations to the industry and the clients.