Know Your Customer

Know Your Customer (KYC) is an important process for financial institutions to prevent financial crime and money laundering. Customer identity verification is the first and critical step.

HONG KONG IDENTITY & VERIFICATION (HKID&V)

Digital technology has made authentication more convenient, but it also comes with risks. To use authentication technology securely, it is important to guard against abuse and fraud such as tampering/forgery of identity documents, forged selfies, photos, videos, and deepfake.

We partner with Tradelink and deliver the renowned eKYC solution. It enables service subscribers to remotely validate HKID cards and verify the identity of the cardholder effectively.

4 Key Features

Support authentication of Hong Kong Smart Identity Cards from 2003 and New Smart Identity Cards from 2018

Verify whether the image in front of the camera is a real person or manipulated image

The solution can be deployed in a self-service kiosk at the client’s site or a mobile application for customer onboarding

Cloud-based solutions as ease of implementation

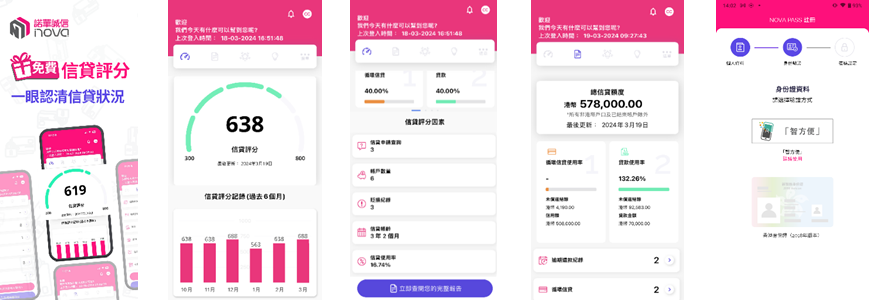

NOVA Check

NOVA Check is a screening solution for detecting, managing and preventing risks for KYC. This service allows financial institutions to verify whether an individual customer has any negative records or political background.

NOVA Check is available for financial institutions from both Hong Kong and GBA.

NOVA Check features

Legitimate sources for screening, including international sanction lists, politically exposed person, negative information, bankruptcy and tax-related information.

International Sanction List

Politically Exposed Person

Negative Information

Bankruptcy and Tax Related Information

Cross-boundary customer due diligence service – Cross-boundary KYC

With the rapid financial integration within the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), there have been growing demands for cross-boundary KYC in the Hong Kong financial sector. However, the channels are limited for verifying individual identities and information of Mainland China customers in the market. We are the first credit reference agency to provide cross-boundary KYC in Hong Kong, intending to fulfill the increasing market needs and mitigate financial risk.

Strengths

Customer identification and verification services covering the whole country

Customer identification and verification services covering the whole country

Latest status of customer profile

Latest status of customer profile

Key Features

Reliable and comprehensive KYC solutions for financial risk assessment and mitigation

Reliable and comprehensive KYC solutions for financial risk assessment and mitigation

Increase efficiency and accuracy of customer due diligence process

Increase efficiency and accuracy of customer due diligence process

Legitimate data sources from reliable partners

Legitimate data sources from reliable partners

Reports are available for audit purposes

Reports are available for audit purposes

Business Background Check

KYB (Know your business) is a crucial process for financial industries to identify and verify the business customer’s beneficial ownership and source of funds, etc.

However, there are very limited cross-boundary KYB and on-site visit services available in the current market for background checking of Mainland China companies. Cross-boundary KYB services may cause additional costs and resources for the process to ensure compliance with PRC and Hong Kong regulations.

Business Background Check Report

Business Background Check Report is a solution for financial institutions in providing KYB reports of Mainland China companies. It helps to gather business information of Mainland China companies legally and conveniently for customer due diligence, portfolio review and account opening. Our solution can enable financial institutions to offer cross-boundary services at a lower cost and provide a better customer experience for clients from Mainland China.

Business Information Report

NOVA has partnered with the leading operator for integrated business and commercial information – CRIF SPA, to deliver Business Information Reports with the latest corporate information across more than 230 countries and regions.

Business Background Check Report Features

KYB reports and monitoring services can provide basic information, in-depth business information, directorship, and litigation records of Mainland China companies. Our solution allows users to inspect if the business of client is under normal operation as well as on a daily basis to monitor the business status in order to identify potential risks and abnormalities at an early stage.

Basic & In-depth Business Information

Directorship